Does your company need a FinOps tool? If so, what kind? How should you evaluate the market, keeping sight of your company’s specific needs among competing vendors? Ternary’s Ultimate FinOps Buyers Guide is designed to answer these questions and more.

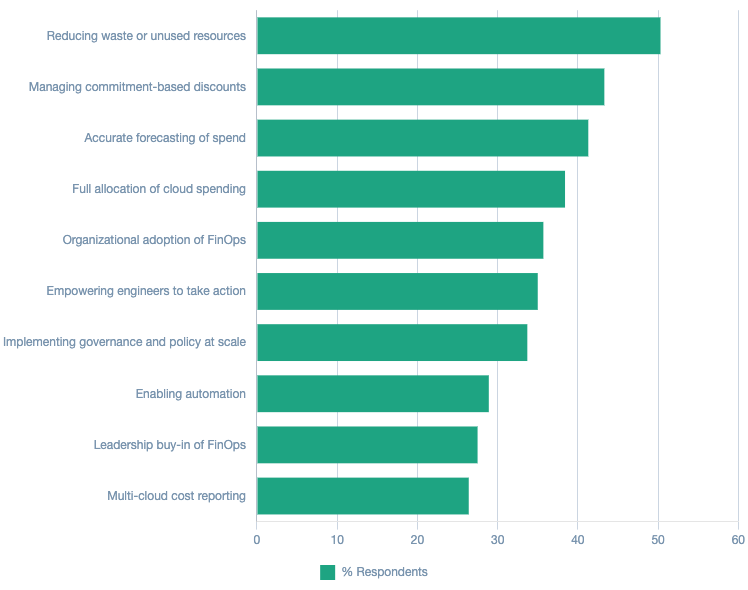

Ten years ago, most companies in this market approached the problem of cloud spend as one of “cost management.” The arrival of the FinOps Foundation, in 2020, redefined this problem as an opportunity to not just save money but to make money and foster a cost-conscious culture.

How have the FinOps tools in the market reflected this game-changing shift, and how can your company make sense of the offerings? Read on for an excerpt from the Ultimate FinOps Buyers Guide. You’ll want to download the guide and refer to it often as you identify the best path forward for your organization’s cloud investments.

Cloud service provider consoles (“native tools”)

If you are just getting started on your cloud journey and are operating primarily in a single cloud, native tools can meet your needs. Companies that require greater customization and flexibility, have moderate to advanced cost use cases, and/or want to manage spend across their multi-cloud and containerized environments should explore third-party platforms.

Cost management tools

The first generation of FinOps solutions, which have been in the market for 10+ years, includes several cost management tools. These were developed to focus on spend reduction. In some cases, these solutions aspired to be cloud management platforms; due to mergers and acquisitions, their parent companies narrowed the scope of these solutions to focus on costs. While these solutions are often referred to as FinOps platforms today, they were not built with FinOps in mind. Note: These tools are often referred to as third-party solutions, meaning they are cloud agnostic (in other words, they are not native to any particular cloud).

FinOps-native platforms

Since the inception of the FinOps Foundation, in June 2020, a new generation of FinOps solutions emerged. Called “FinOps-native” platforms, they incorporate the principles of FinOps at every level. In many cases, the founders of these FinOps platforms include previous customers, partners, or employees of companies offering first-generation (cost management) tools. Note: These FinOps-native platforms are also referred to as third-party solutions, because they are cloud agnostic.

Point solutions

Point solutions, also referred to as niche players, are built to solve a specific market challenge or use case. For example, they might manage Kubernetes costs or automate commitment-based discount management. Such tools are typically used in conjunction with one of the aforementioned solutions.

Do-it-yourself (DIY)/homegrown solutions

Some companies choose to build their own solutions to increase the efficiency of their cloud investments. These solutions may leverage a combination of native tools, spreadsheets, and business intelligence tools (e.g., Looker, Tableau, etc.). Although this approach works for some companies (namely large enterprises with complex organizational structures), industry experts do not typically recommend this approach. Companies pursuing this path must dedicate engineering personnel to support the homegrown solution. They must also take into account the time and costs associated with developing and maintaining the solution, as well as the impact on business productivity. The FinOps Foundation advocates for a hybrid approach: purchasing a platform that meets most of your needs and then building custom solutions on top to address your organization’s unique needs.

If you’re in the market for a FinOps solution, it’s important for you to understand the vendor landscape and the capabilities that each solution provides. Ternary’s Ultimate FinOps Buyers Guide provides you with the strategic and technical questions you should be asking vendors as you consider purchasing their solutions.