On February 22, 2024, the FinOps Foundation released results of its annual State of FinOps survey. In case you’re not familiar with the State of FinOps, this survey provides insights into the demographics of FinOps practitioners, key challenges companies are facing, and industry trends. Because the foundation fine-tunes the survey each year, year-over-year comparisons aren’t available for some questions. That said, as a longtime member of the FinOps community, I have followed the survey’s results each year. Here are some key takeaways from this year’s survey that I want to share with you.

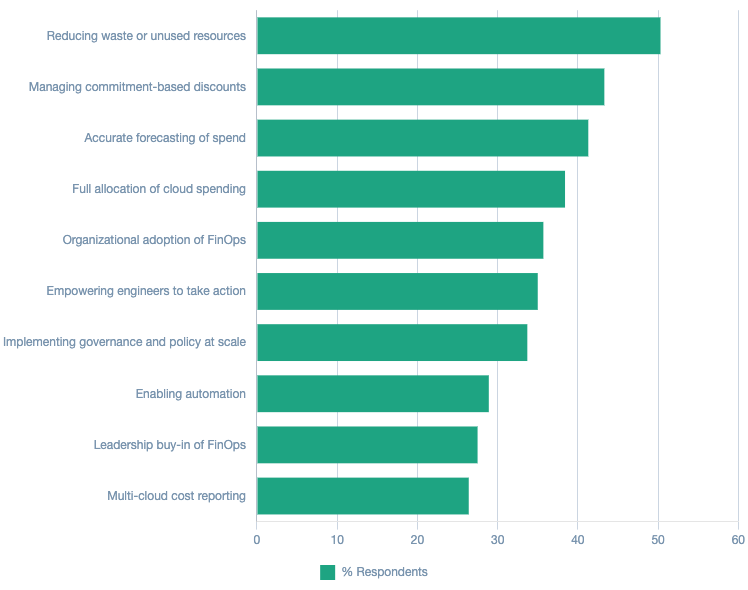

1. Reducing waste is now respondents’ top concern.

For the first time since 2020, “empowering engineers to take action” is no longer the highest priority for FinOps teams. Instead, respondents reported their top priority as “reducing waste or unused resources.”

What brought on this change, you may ask? I have a few thoughts on this.

Since becoming a part of the Linux Foundation in 2020, the FinOps Foundation has emphasized the narrative that building alignment between engineering, finance, and business teams is key to a successful FinOps journey. Indeed, FinOps is a response to years of disconnection between these teams. Now that FinOps practices are more widespread, that disconnect may be less pronounced, allowing a shift in focus. It’s also possible that previous survey respondents subconsciously considered “engineers taking action” as their top challenge simply because that supported the FinOps Foundation’s narrative.

For years, organizations believed that migrating to the cloud would result in cost savings. As it turns out, that was a myth. Results vary by company and by migration strategy; but, as we’ve all seen, a lift and shift doesn’t by itself decrease spending. Fast-forward to 2024: As more organizations adopt multi-cloud strategies, they’re realizing that the need to reduce waste and/or unused resources can’t be overlooked.

I’d be remiss if I didn’t acknowledge that the current economic climate may be playing a significant role in the survey’s reported shift from empowering engineers to saving money. As we’ve all seen in the news, many companies are tightening budgets and announcing layoffs. Against this global backdrop, it makes sense that organizations would seek opportunities to cut costs and improve the bottom line.

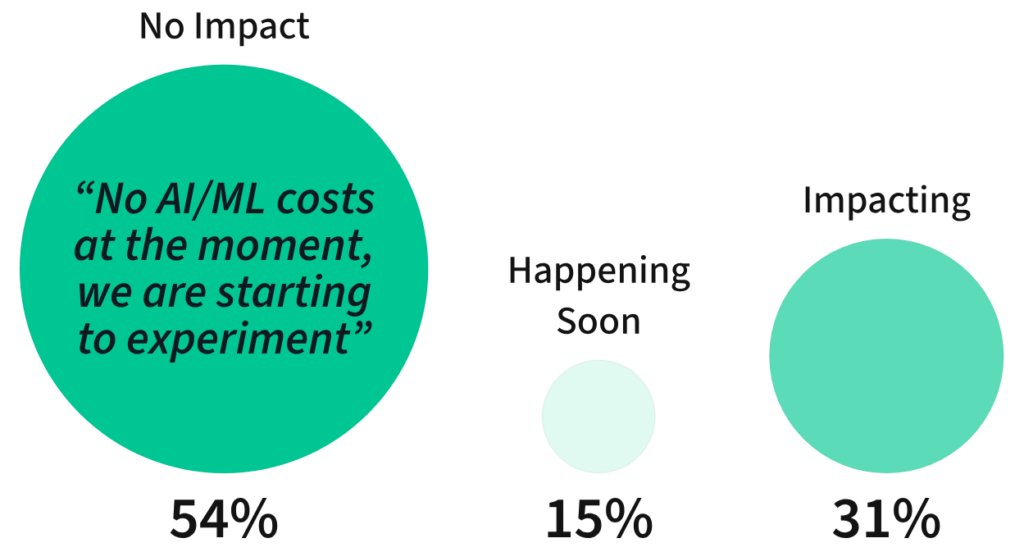

2. AI/ML, hot or not? It’s complicated.

I don’t think there is a current survey from any organization that doesn’t include questions related to artificial intelligence (AI), machine learning (ML), or generative AI. AI/ML was the hot topic of 2023, and that trend continues in 2024.

When it comes to FinOps, AI/ML needs to be considered from a tooling perspective (i.e., whether or not a platform leverages AI/ML algorithms to power key capabilities like forecasting, anomaly detection, etc.). But it should also be seen from a practitioner perspective, as organizations experimenting with AI/ML for their business innovations need to manage those costs. AI/ML may soon become a big expense for the many businesses that seek to leverage this technology in their applications. But, for now, only 31% of organizations reported seeing an impact.

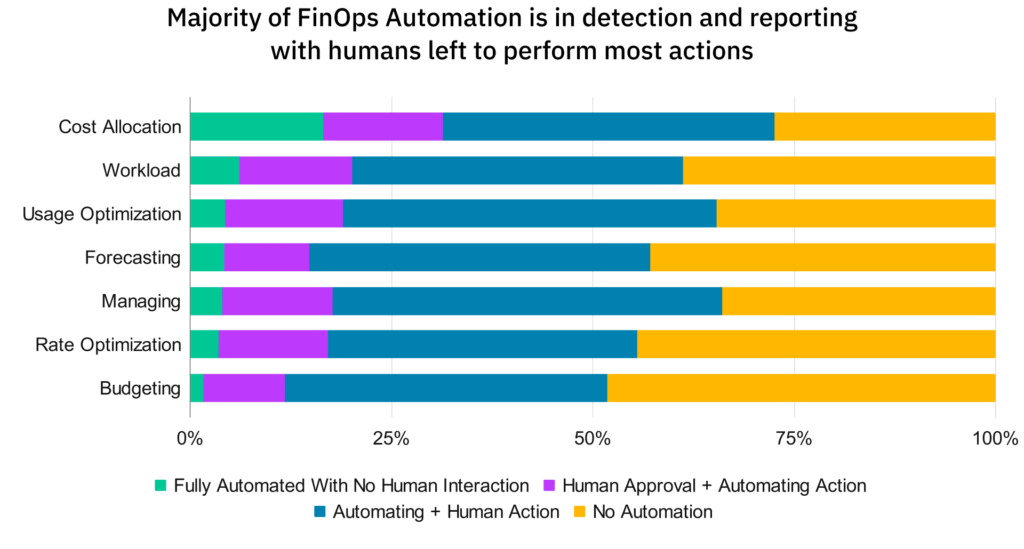

3. Discomfort with automation persists.

I’m not surprised that few organizations trust third-party solutions to automatically make infrastructure changes on their behalf. I have always found automation to be an interesting topic with regard to FinOps practices. Automation can be confined to detection and alerting, going further, it can also be used to implement decisions based on those detections or alerts via an action. From my experience, I have seen that, while some organizations are comfortable with a platform taking action on their behalf, the majority of organizations find alerting to be sufficient.

If you are a practitioner, I encourage you to be specific when inquiring about a given vendor’s automation capabilities. Does the vendor’s automation support customized alert thresholds? Can the tool automatically purchase and exchange commitment-based discounts? How about deletion of unused resources or lights-on/lights-off for non-production workloads?

Access control is another critical consideration for automation. In your organization, who should have the authority to approve an automated action in the platform? Such decisions will vary by organization, based on the level of maturity, regulatory oversight, and potential impact to the business if something goes wrong.

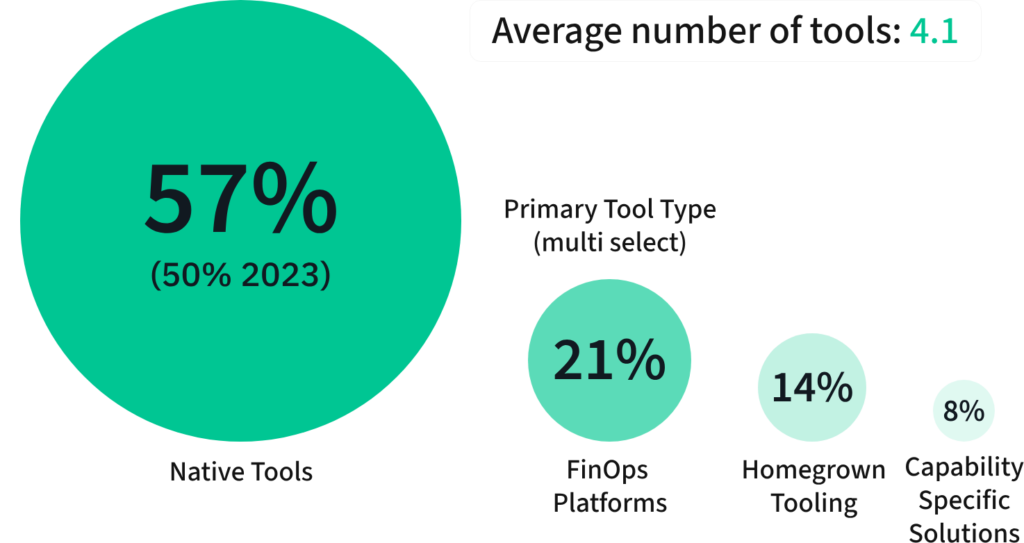

4. The State of FinOps does not include vendor comparisons.

The FinOps Foundation prides itself on being a vendor-agnostic organization, and I am extremely impressed by how it supports the community of practitioners, maintaining a non-commercial environment. As FinOps adoption proliferates, analyst firms are increasingly publishing vendor-comparison reports for this market. So it makes sense that, in 2024, the FinOps Foundation no longer shares detailed tooling data, leaving the comparisons to the analysts.

I will note, though, that many practitioners in the community look to the FinOps Foundation for guidance when deciding which platform or tool to use. Hopefully, practitioners seeking the best vendors and partners for their current needs can continue to leverage insights from fellow-practitioners via FinOps Foundation events and channels.

While no longer offering detailed tooling data, the FinOps Foundation still provides high-level tooling data. Its 2024 survey shows that the average number of tools used by organizations remains stable: 4.1 across native tools, FinOps platforms, homegrown tooling, and capability-specific solutions.

Looking at the data below sparks a few questions in my mind: Do organizations that use native tools also use at least one of the other solution types? How does this average change according to cloud provider? Does organizational investment in homegrown tools reflect a gap in the incumbent market solutions? I’d be curious to see the raw data behind these high-level findings.

Conclusion: Questions remain.

I love that a hallmark of the FinOps community is its collaboration and openness to discussion. So I invite you to share your perspective. What did you think? Did different data points stand out to you? Do you agree or disagree with my opinions?

Read more about what Ternary foresees in the coming year for FinOps, and contact us to share your thoughts about the State of FinOps 2024.

Learn more about how Ternary can help you tame your organization’s cloud spend.