Starting in 2011, an early crop of startups were born to tackle a relatively new problem: transparency in cloud infrastructure costs. The challenge was less complex than it is today but as with all new frontiers, the explorers who chose to venture into the uncharted waters faced uncertainty as they developed a new category of tools in the early ascent of cloud computing. Around the same time, Amazon Web Services, Microsoft, and Google released early versions of their billing consoles and cloud cost management tools. These native tools were built to help customers visualize, understand, and manage their costs and usage over time.

The premise was good from the outside: provide the customer with free tools to help them manage what they are spending so that they can deliver their cloud infrastructure to plan. The challenge that early cloud customers faced was whether to pay a percentage of their cloud spend to a startup or rely on very limited resources from the cloud service providers (CSPs) to manage their spend.

The role of native tools

The question that’s been asked since that day is: If native tools are good enough for customers to actually manage their spend, why are they all overspending? Why are the CSPs’ customers still turning to third-party tools to get the most value from their cloud spend?

One answer is straightforward, in that your overspend is the CSP’s profit. Another take is that CSPs are incentivized to hold onto you as a customer and grow the revenue associated with your account. Although they may want to help you optimize costs, they aren’t able to build the tools necessary to do so and organizations struggle to trust their business metrics and data to a CSP. Anecdotally, 94% of organizations report that they are still wasting money in the cloud.

While there is insight to be gained and the native cloud cost management tools are better than doing nothing, these free tools come at a price. The cost you pay as a customer is lock-in, degraded visibility, and potentially less-optimized calculations for financial instruments recommended to you. You are left to rely on the CSP’s recommendations for savings, which may lack the overall context needed to make robust decisions and in the end be the wrong investment for you. If you disagree with this, ask yourself: Have you ever verified the numbers behind these recommendations? Has your billing data ever been inaccurate? Do you know how to verify it and know if it’s been inaccurate?

When to use native tools

With all of this said, there are situations where native tools may be right for you and your organization:

- If you are a startup, small company, or nonprofit spending a small percentage of your revenue in the cloud

- If you operate in a single cloud and do not have additional costs from other ISVs

- If you are new to FinOps and need a simple starting point for cost visibility

- If your reporting needs don’t require customization, cost allocation, or modification of tags and labels

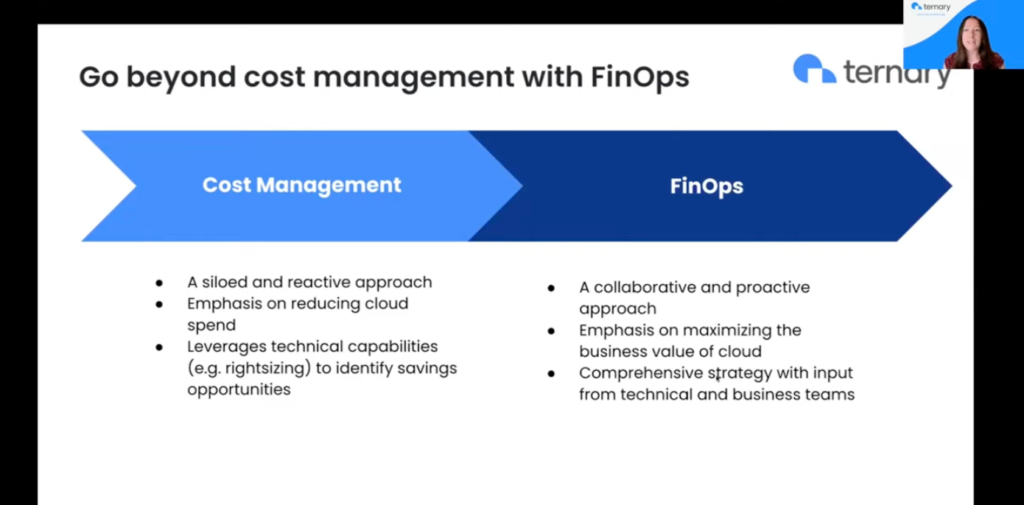

Why you should invest in a FinOps platform

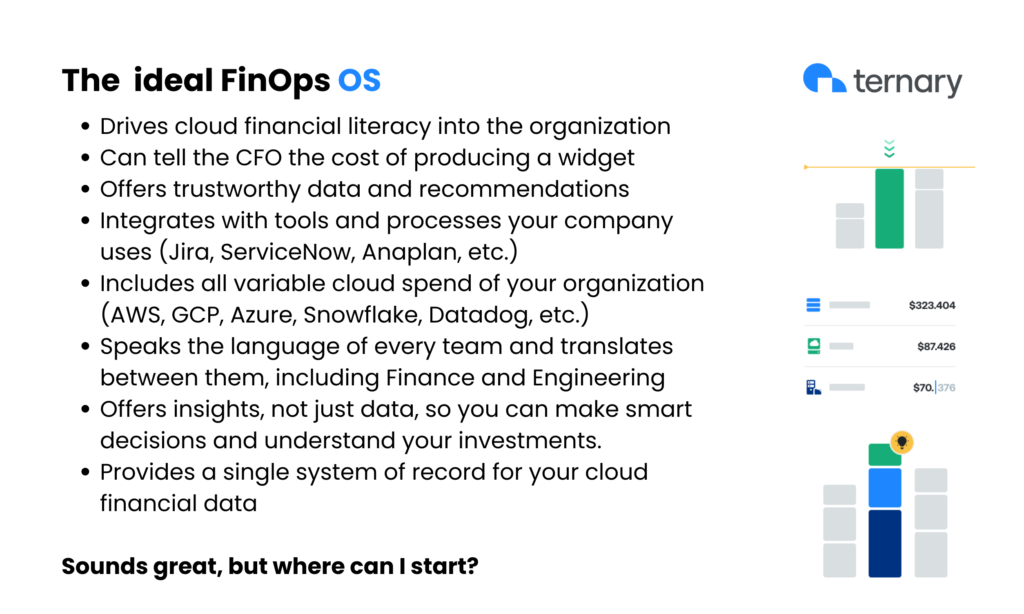

What’s great about FinOps platforms is that they are Switzerland among the CSPs. As a trusted third-party, a FinOps platform enables you to:

- Ingest and normalize data from multiple clouds and data sources, giving you a true single pane of glass

- Customize reports to accommodate complex business structures and requirements

- Foster communication and collaboration across technical and business teams

- Perform advanced cost optimization techniques

We believe this conversation is going on behind closed doors. In writing this article, we wanted to bring this potentially unpopular opinion to light. We’d love to hear your thoughts on native cloud cost management tools, so feel free to contact us. If you’re interested in learning more about Ternary, you can request a demo.