January 4, 2024

FinOps—once a niche discipline with tremendous promise—has become a recognized necessity for companies, providing a framework for cloud decision-making so innovation and investment can progress sustainably.

FinOps is a must-have and evolving quickly.

Ternary’s team comprises thought leaders, operators, and original team members who were in the room when FinOps was born. We’ve put together our 2024 FinOps predictions, based on what we’re seeing in the market and hearing from our customers about how companies can improve their cloud efficiency.

Growing cloud investment will continue to accelerate FinOps adoption

- More Global 2000 companies will embrace FinOps as cloud investment continues to rise. In 2023, we saw a huge number of companies adopt FinOps; spending to plan is now an established necessity, and FinOps specialists are in demand. Amazon, Microsoft, Google, and Oracle all joined the FinOps Foundation, increasing the ease of adopting FinOps best practices.

- As cloud usage accelerates, companies will ask more of FinOps. Adopting the FinOps Framework or hiring a FinOps team will be the starting point, not the solution in itself. Visibility into cloud spend (e.g., showbacks and chargebacks) won’t be enough; instead, customers will seek easy ways to analyze disparate and complicated data and enable efficient decision-making.

AI investment will increase

- Companies with cloud-based LLM and GAI workloads will need to manage skyrocketing cloud costs and growing infrastructure budgets. Strict budgeting and forecasting, cost optimization, and collaboration among teams will be key. While we don’t expect IT budgets to include GAI until next year, AI investment will rise in 2024 as companies experiment with adding it to their processes and products.

- Many companies will seek to limit the environmental impact of AI’s data workloads. These workloads will spark not just higher cloud bills but also growth in energy usage and greenhouse-gas emissions. Companies will respond with efforts to quantify and reduce cloud waste.

In a changing economy, companies will seek both extensibility and control

- Economic uncertainty will push finance teams to demand effective cost guardrails. Companies will offset uncertainty—both in the overall economy and in cloud’s fluctuations—by seeking predictability in costs alongside freedom to respond to changing markets.

- More companies will demand fixed-price cloud cost management solutions with no overage charges, so that there’s no financial penalty for scaling up.

The realities of multi-cloud will demand a unified, automated approach

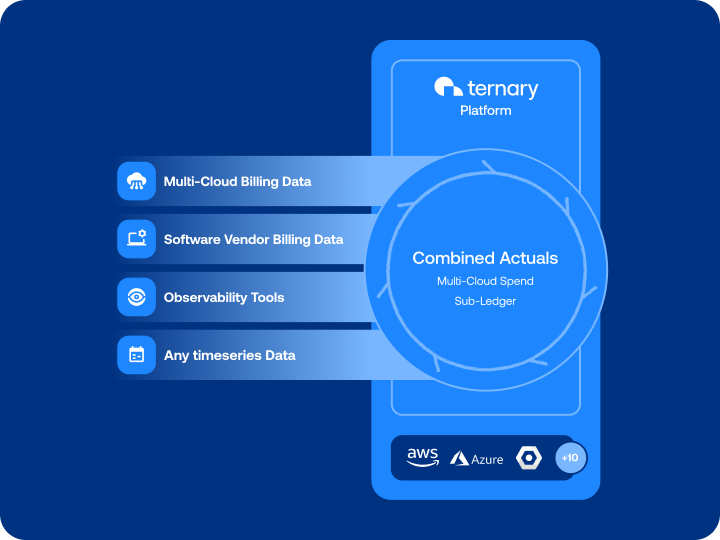

- The future is multi-cloud. Companies acquiring other businesses also acquire new cloud environments. While they may have used solely GCP or AWS in the past, single-cloud billing consoles don’t account for today’s multi-cloud realities.

- Companies will seek multi-cloud FinOps solutions to provide standards across cloud bills. For example, the FinOps Foundation’s FOCUSTM billing standard is a standardized format that can be used for any combination of cloud providers and SaaS products generating billing data. Businesses will turn to solutions like FOCUS so they can spend more time actioning data (and less time cleaning data).

- Many enterprises will seek third-party FinOps software and services so they can focus on core competencies. As enterprises adopt more complex cloud processes and extend their FinOps teams, they will face the question of how to continue prioritizing core competencies over cloud cost management. Third-party providers can help by complementing businesses’ existing processes and infrastructure.

- Companies will increasingly take advantage of automation to drive innovation and profits. Instead of migrating to the cloud to save money on their infrastructure, businesses will increasingly recognize not just the opportunity but the necessity of delivering cloud-based innovations that differentiate them from competitors.

Amid increased automation, human intelligence will remain a differentiator

- Human insight and leadership will be key in interpreting patterns surfaced by AI. Given AI’s novelty, it would be a mistake for companies to trust that, in cloud cost management, they can “set it and forget it.” Until AI/ML have perfect business context—if they ever do—FinOps professionals will continue to play a key role in the “last mile” on the cloud cost management journey.

- Even as automation plays a bigger part, enterprises and MSPs will seek partners and tools that can adapt to rapidly changing conditions—and that innovation will continue to be led by forward-thinking teams of people.

Ternary will continue building for the future

Our team’s goal in 2024 is making it easier for companies to ask questions of their data. We invest in research and development to provide customers with ever-more-advanced cloud cost management capabilities, so they can focus less on untangling multi-cloud bills and more on their businesses’ core competencies and goals.

Amid AI’s many promises of upheaval, one thing remains consistent: the role of a great human team with a record of customer-responsive features development. By choosing Ternary, customers gain access to a proven platform and a team of forward-thinking FinOps experts to help them stay ahead of change’s curve.

To dive deeper into your company’s FinOps future, book a demo today.