Why should Finance care about cloud costs? Ask yourself: Is your team surprised by your organization’s growing cloud bills? How do you know that your cloud bills are correct? Do you have a clear projection for when engineering will exceed its cloud budget? Do you have real-time visibility into spikes in spend that could push you over budget? Can you tie every dollar of cloud spend to the products and services that impact your profitability?

Answering these questions demands that you proactively analyze your cloud spending. Cloud costs are a significant expenditure for most companies, and controlling those costs requires cross-functional effort. Read on to learn how Finance can guide your organization to make good cloud investments.

Finance’s role in FinOps

FinOps is a blend of Finance and DevOps. In December 2023, the FinOps Foundation’s Technical Advisory Council defined it this way: “FinOps is an operational framework and cultural practice which maximizes the business value of cloud, enables timely data-driven decision making, and creates financial accountability through collaboration between engineering, finance, and business teams.”

FinOps addresses common challenges that finance teams face when it comes to cloud spending. These include unpredictable costs, holding teams accountable for cloud consumption, and the problem of connecting cloud spend to unit costs. FinOps helps you understand your organization’s cloud costs to normalize spend predictability, prepare accurate forecasts, and effectively manage budgets.

What if you don’t have a significant cloud footprint now? You should still think about how you can proactively manage your cloud spend. Why? Because global cloud infrastructure services spending is expected to increase by 20% this year. Plus, the artificial intelligence (AI) boom will be a key driver of spending. What remains to be seen is how AI implementation will impact cloud costs at scale. For finance professionals, it will become increasingly important to analyze AI costs and map them back to key business metrics. By establishing cloud cost transparency now, your organization can prepare for any surges in spend.

How Finance can dive into the mix

Based on the State of FinOps data, FinOps teams report to a Chief Technology Officer or Chief Information Officer approximately 69% of the time. Do you engage with your engineering and operations teams regularly (monthly, quarterly, or annually)? If not, you’re trusting them to make the right cloud financial decisions for your company, by default. But given your financial expertise, you can and should claim the driver’s seat to help your organization mature its FinOps practice.

- Assess the commitments and discounts that procurement negotiated with cloud service providers (CSPs).

- Learn key cloud terminology and rate optimization strategies (e.g., commitment-based discounts) to better communicate with engineering and FinOps teams.

- Identify which FinOps tool(s) your organization has already implemented.

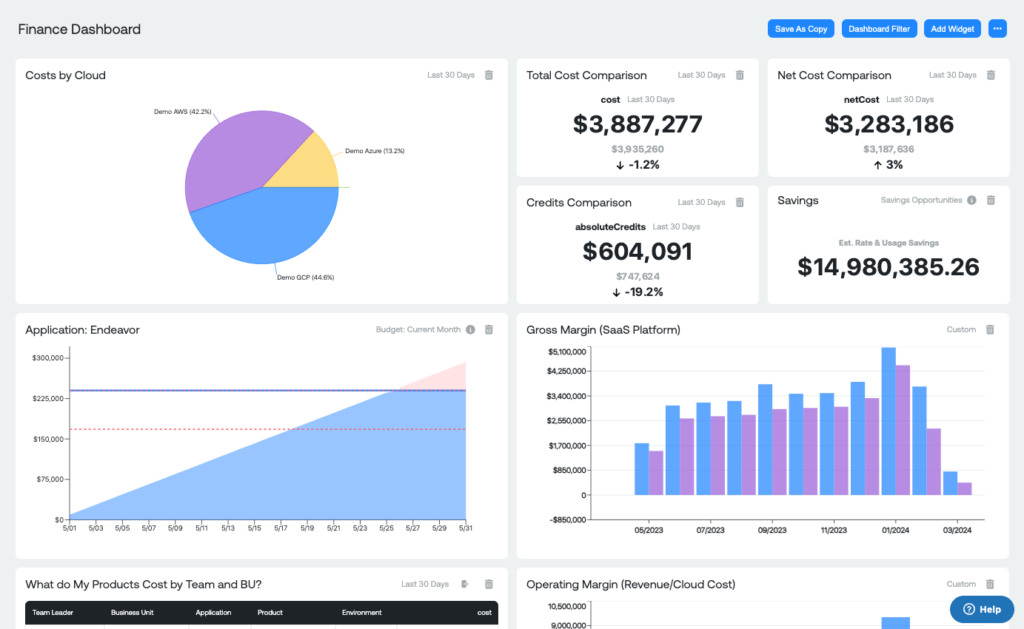

- Ask yourself what reporting requirements you have for the FinOps team, including:

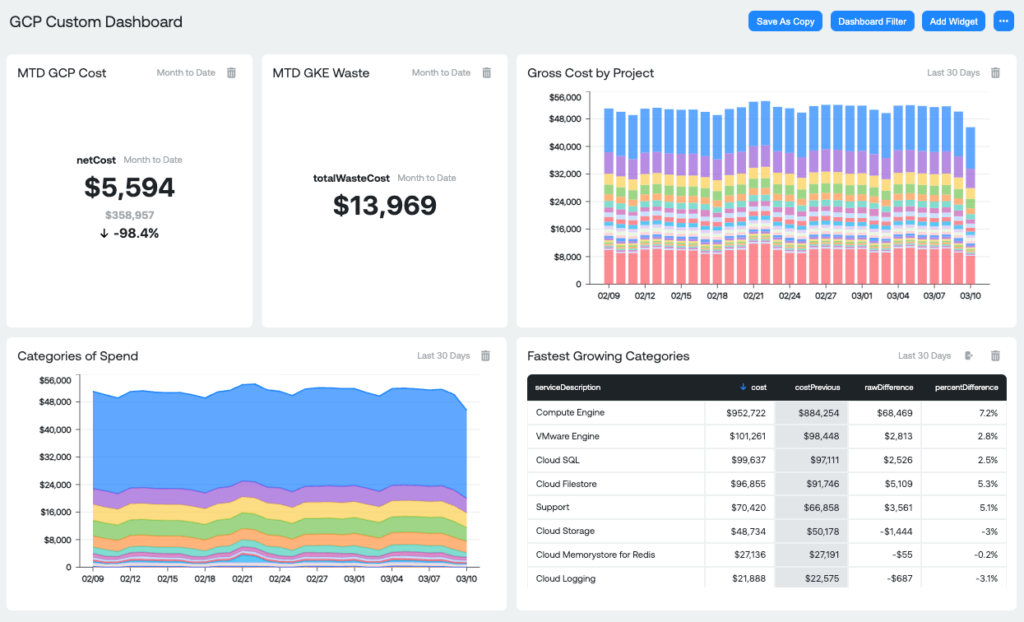

- What measures and dimensions do you want to see (e.g., net costs, credits, etc.)?

- Do you want your reports and dashboards broken out by cost center, line of business, and/or other groupings?

- Do you prefer to visualize the data as a bar graph, pie chart, etc.?

- What subscription reporting schedule works best?

- Collaborate with the FinOps team to understand historic billing data, allocate costs to business groups, build accurate forecasting models, and perform chargeback.

Once you have a strong understanding of key cloud concepts, you can further your involvement:

- Collaborate with the FinOps team regularly to purchase and manage those commitment-based discounts (e.g., Reserved Instances, Savings Plans, Committed Use Discounts).

- Provide input to the FinOps team so your organization can define unit economics metrics. If you’re a Chief Financial Officer (CFO), you are ultimately responsible for managing cash flow and analyzing the company’s financial position to drive profitability. Unit economics data can help you track the impact of cloud against key metrics. These include cost of goods sold, gross margins, and revenue.

Building a cost-conscious culture doesn’t happen overnight, so don’t wait to get involved.

Why invest in a dedicated FinOps platform

Your discussions with FinOps and Engineering will uncover which FinOps tool(s) your organization has already adopted or plans to evaluate. It’s important that you understand the nuances and weigh in on any tooling decisions.

For example, CSP consoles (“native tools”) can work for organizations starting their cloud journey, operating primarily in a single cloud. However, native tools are designed to be used by technical professionals. As someone in finance, you’ll likely experience a learning curve when navigating the native tools. You will also need your administrator to grant you access permissions, which can increase business risk. Not to mention that if you are a multi-cloud company, you’ll need to extract the data from multiple native tools. Finally, you’ll need to leverage spreadsheets and/or a business intelligence tool (e.g., Looker, Tableau, Power BI) to further analyze, manipulate, and visualize the data.

What if your organization adopts a do-it-yourself or homegrown approach to tooling? As a finance professional, you’ll want to thoroughly assess the total cost of ownership. Your organization will require a dedicated staff and budget to build the solution. Don’t forget that, once they build a tool, your teams must maintain it—an ongoing business cost. This approach can work for companies with significant resources at their disposal, but it may not suit your company.

For organizations that require greater customization and flexibility, have moderate to advanced cost use cases, and/or need to manage spend across a multi-cloud environment, investing in a third-party FinOps platform is the recommended approach.

Ternary speaks the language of finance teams

Purpose-built for FinOps, the Ternary platform fosters communication between Finance, Engineering, and FinOps teams. If you can use spreadsheets, you can use Ternary. It’s that easy and intuitive. Whether you log in to the platform regularly or prefer to have reports subscribed to you, you can benefit from the actionable insights that Ternary provides. Ternary enables finance teams to drive accountability for cloud spend, optimize costs, and spend-to-plan.

Ready to take an active role in your organization’s FinOps practice? Request a demo to start your journey today.