Today, the FinOps Foundation released its 5th annual State of FinOps survey. With 861 global respondents, this survey offers valuable insights into FinOps practitioners’ key priorities and industry trends. It’s worth noting that the questions are refreshed annually, with some added or removed based on trends. That means year-over-year comparisons aren’t always possible.

Here are the key takeaways from the State of FinOps 2025.

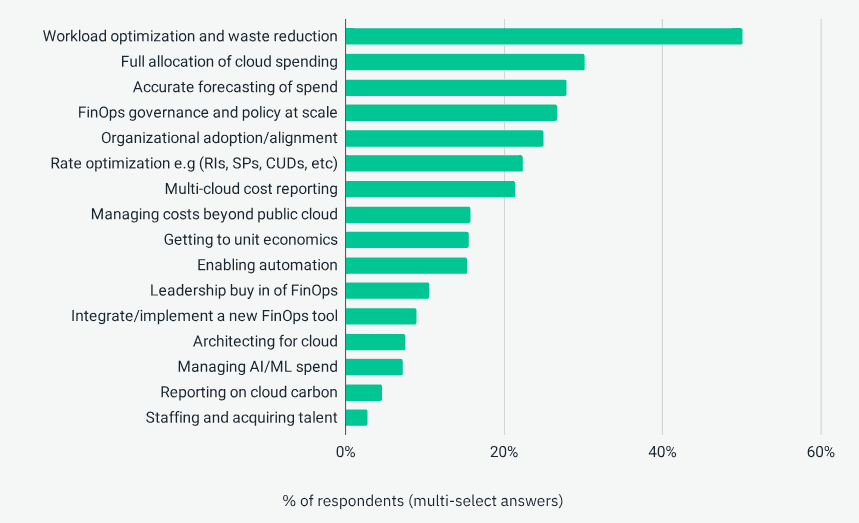

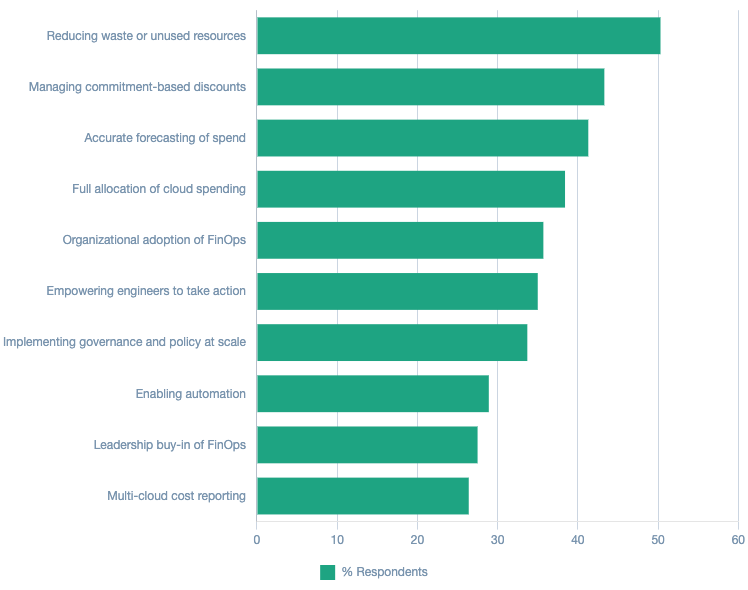

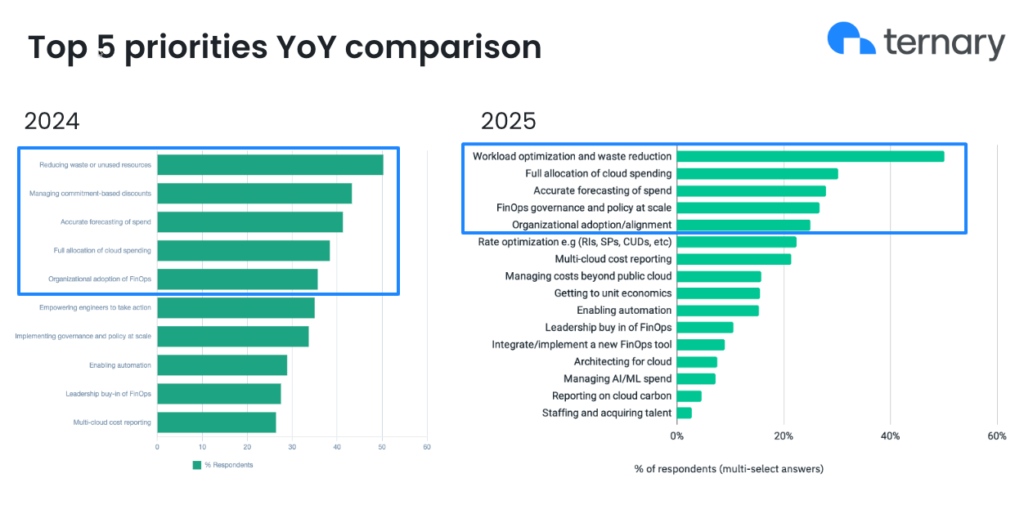

1. Waste reduction remains the top priority

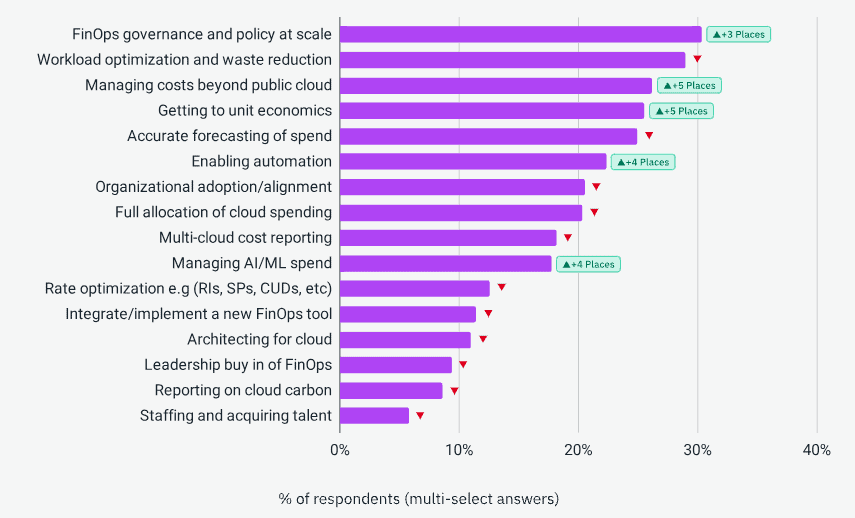

The latest State of FinOps survey results reveal that, for a second year, reducing waste remains the top priority. Last year, reducing waste displaced getting engineers to take action as the top priority. (Engineers taking action no longer appears on the priority list at all.) Other top priorities have remained fairly consistent, including waste reduction, accurate spend forecasting, and full allocation of cloud spending.

However, managing commitment-based discounts has dropped to number six. A potential reason for this is the community’s global growth, with 861 respondents this year (up from 658 respondents last year). This growth may indicate that international organizations, newer to FinOps, are focusing primarily on the Inform phase rather than the Optimize phase.

As seen in the comparison below, organizations had more options to choose from for their top priorities. Note how low managing AI/ML spend ranks on the list; we’ll address that later in the article.

Source: State of FinOps by FinOps Foundation

Looking ahead, FinOps governance and policy at scale is set to become the top priority by 2026. This trend highlights the need for the cultural shift that FinOps drives. Automation remains absent from respondents’ top priorities, signaling organizations’ hesitance toward full automation. This is important because, while many people group governance and automation together, respondents have clearly separated these priorities. An effective FinOps practice depends on governance and policy at scale, driving stakeholder buy-in across the organization to build and maintain an effective practice.

Source: State of FinOps by FinOps Foundation

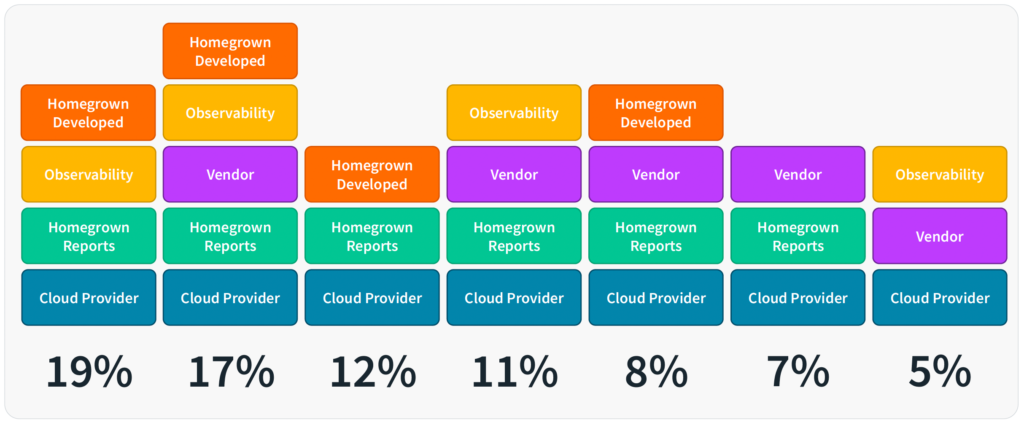

2. “Build and buy” dominates tooling strategies

The survey asked what respondents need to achieve their top priorities. This year, 34% said they need investment (e.g., more upskilling) and tooling, up 20% from last year. The State of FinOps 2025 shows that practitioners are using a wide range of tooling combinations. Notably, homegrown reports and custom-developed tools are common across the majority of practitioners. This isn’t surprising, as many organizations have specific needs that platforms can’t always accommodate.

That’s why Ternary has long supported a “build and buy” approach. Our platform helps organizations meet 80%–90% of their needs, while providing API-first tools to customize the remaining percentage. To learn more, watch the video recap of our breakout session from FinOps X 24. In the session, representatives from the Linux Foundation discuss adopting a “build and buy” approach with Ternary.

Source: State of FinOps by FinOps Foundation

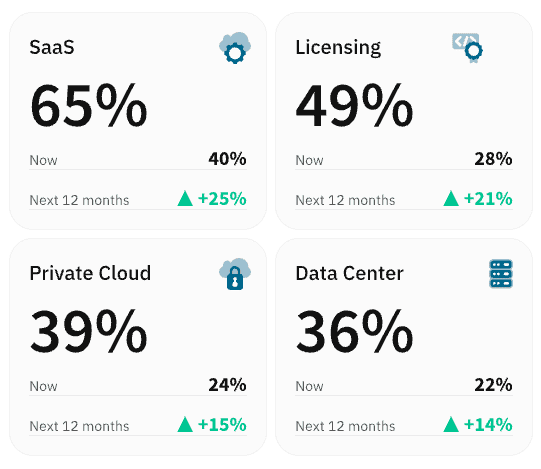

3. SaaS leads the way as the most watched FinOps scope

In 2024, the FinOps Foundation introduced “scopes” as a new component of the FinOps Framework. A FinOps scope is defined as “a segment of technology-related spending to which FinOps practitioners apply FinOps concepts.” Companies are increasingly adopting FinOps principles beyond public cloud infrastructure. The State of FinOps 2025 reveals that 65% of organizations will include SaaS spend in their FinOps practice, followed by licensing (49%), private cloud (39%), and data centers (36%). Practitioners plan to focus on key capabilities such as budgeting, allocation, and forecasting across these scopes.

Source: State of FinOps by FinOps Foundation

4. AI is hot right now

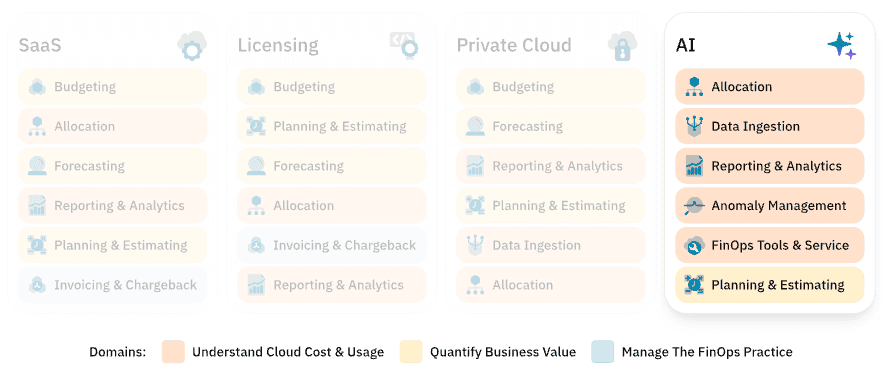

Last year, everyone was talking about AI, but only about one-third of respondents were actually using it. Now, with the AI boom in full swing, 63% of organizations are managing AI spend, up from 31% in 2024. So, to answer my question from last year (Is AI hot or not?): It’s definitely hot. Companies worldwide are actively experimenting with AI, and those that aren’t will be soon.

The challenge for FinOps is that it’s still unclear how these new applications will affect cloud spend. As a result, practitioners are focusing on allocation, reporting, and anomaly management as the top capabilities for managing AI spend. The jury is still out on whether FinOps for AI will be treated as its own capability or scope by practitioners, or if AI will simply be treated like any other cloud service. However, the top priority list and areas of focus for AI seem to lean towards the latter.

Source: State of FinOps by FinOps Foundation

Conclusion: No surprises, plenty of insights

Overall, the State of FinOps 2025 survey results aligned with our expectations. Reducing waste, the “build and buy” approach, SaaS, and AI continue to dominate conversations with our customers and partners. One notable gap this year is the lack of data on how many companies rely on managed service providers as their FinOps team or trusted guide. Given our partner-first strategy, we believe there’s more to be done in the community when it comes to partners.

What were your takeaways from the survey? Did anything surprise you? We’d love to connect and discuss these trends, as well as how Ternary is helping practitioners control cloud costs and unlock efficiency.