In the landscape of modern governance, managing cloud finances effectively is crucial. The concept of FinOps for Public Sector is not just about cost-cutting; it embodies a comprehensive approach that enhances collaboration, transparency, and efficiency across various government agencies.

In a recent interview published by the FinOps Foundation, Melvin Brown II, deputy executive director at the US Office of Personnel Management, sheds light on the future of FinOps in the public sector, emphasizing the progress made so far using the FinOps Framework and the unique challenges faced by government agencies.

The essential role of FinOps in cloud adoption

As agencies across the public sector embrace cloud technologies, establishing a FinOps practice becomes imperative. This practice not only facilitates cost management but also ensures that services are delivered efficiently. Brown highlights that US federal agencies utilizing cloud services have implemented a FinOps practice, allowing for a unified approach to optimizing public cloud spend.

However, a challenge remains in harnessing the full value of cloud, and that’s cloud provider commitment discount policies that aren’t aligned with government budgeting and spend cycles. These policies currently restrict agencies from making long-term commitments that could lead to substantial savings. For instance, while commercial entities can reserve cloud instances for multiple years, government agencies often face restrictions that limit them to one-year budgets. This discrepancy presents a barrier to optimizing cloud costs effectively.

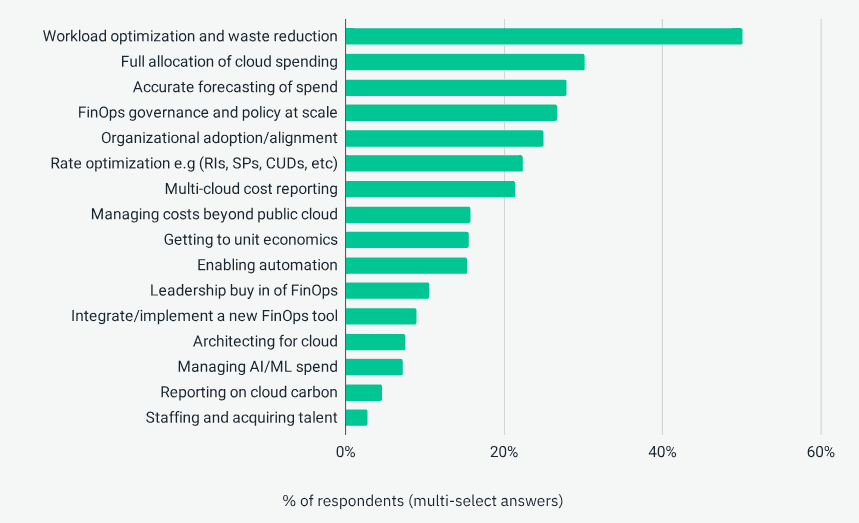

Forecasting spend: A major hurdle

One of the most pressing issues in FinOps for Public Sector is the ability to forecast spending accurately. Current budget cycles do not support precise forecasting for cloud expenses, making it challenging for agencies to plan effectively. Brown points out that the lack of adaptability in forecasting can lead to missed opportunities for savings, as agencies are unable to take advantage of discounts typically available to the commercial sector.

Moreover, the public sector often operates with multiple budget appropriations, further complicating the forecasting process. Many agencies are constrained by the necessity to spend allocated funds within a single fiscal year, which can lead to hasty spending decisions that do not align with long-term strategic goals. Brown advocates for a re-evaluation of these policies to enable agencies to commit to longer-term cloud investments, thereby unlocking potential savings and efficiencies.

Collaboration across departments

An effective FinOps practice for government agencies relies on collaboration, especially across security, procurement, and finance teams. Brown stresses the need for partnering with security experts to optimize spending on security measures without compromising safety. This ensures efficient resource allocation while balancing security needs and budget constraints.

Building stronger relationships with procurement teams is also crucial. Educating them on cloud service acquisition helps shift perspectives from fixed costs to utility-based agreements, improving financial management and transparency.

Establishing transparency with chief financial officers (CFOs) is equally important. Brown highlights that clear visibility into spending allows CFOs to track taxpayer dollars and foster accountability. Unlike traditional environments, cloud services provide real-time insights into spending patterns, enhancing decision-making. As agencies track cloud usage, they can identify optimization opportunities and ensure that decisions align with their missions while maintaining fiscal responsibility.

Evolution of FinOps beyond the cloud

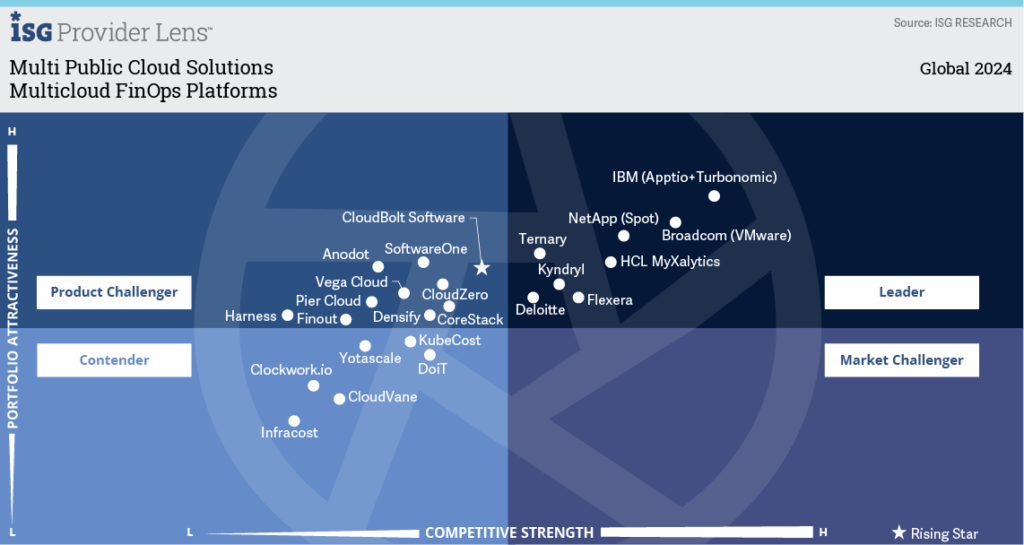

Brown discusses the evolution of FinOps practices in the public sector over the past two and a half years. Agencies have made significant progress in establishing foundational practices, but they now recognize the need for more sophisticated tools to manage cloud resources effectively. The next phase of adoption involves optimizing Software as a Service (SaaS) licensing costs to maximize the value of investments.

While FinOps has primarily focused on cloud financial management, there is potential to extend its principles to data centers. Brown argues that even without physical data centers, FinOps can offer transparency and visibility into spending. This is especially useful for agencies moving away from traditional data center models. By fostering collaboration across departments, agencies can develop a cohesive strategy that aligns financial goals with operational needs. This results in better decision-making and resource allocation.

FinOps is more than just savings

It’s crucial to understand that embracing FinOps for Public Sector is not solely about cutting costs; it’s also about avoiding unnecessary expenses. Brown emphasizes that agencies should not pay for more capacity than they require to fulfill their missions. This foundational principle drives the shift toward smarter spending and ensures that public funds are utilized efficiently.

Embracing FinOps in the public sector is not just a trend; it’s a necessity. As agencies adopt cloud technologies, FinOps ensures that taxpayer dollars are spent wisely and services are delivered efficiently.